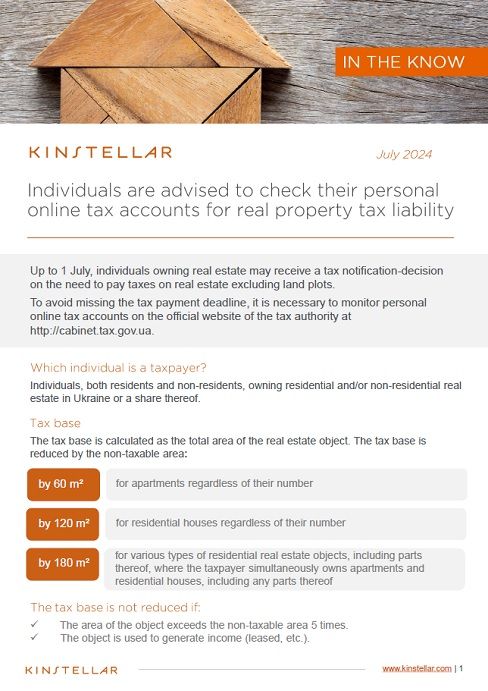

July 2024 – In Ukraine, individuals are obliged to pay the respective real estate tax upon receiving a notification-decision from the tax authorities, which should arrive by July 1. Even if such a decision is not received by this date, the tax authorities still have a three-year period within which valid payment notifications can be sent. The tax authority regularly updates its tax database, so the safest way to check one’s tax liability is to use a personal online tax account on the official website of the tax authority.

The attached alert outlines the key points regarding the payment of real estate tax for individuals, namely who must pay the tax, in what amount, within what time frame, etc. Please read below our overview in English and in Ukrainian.

| Download in English: | Download in Ukrainian: |

|---|---|

|